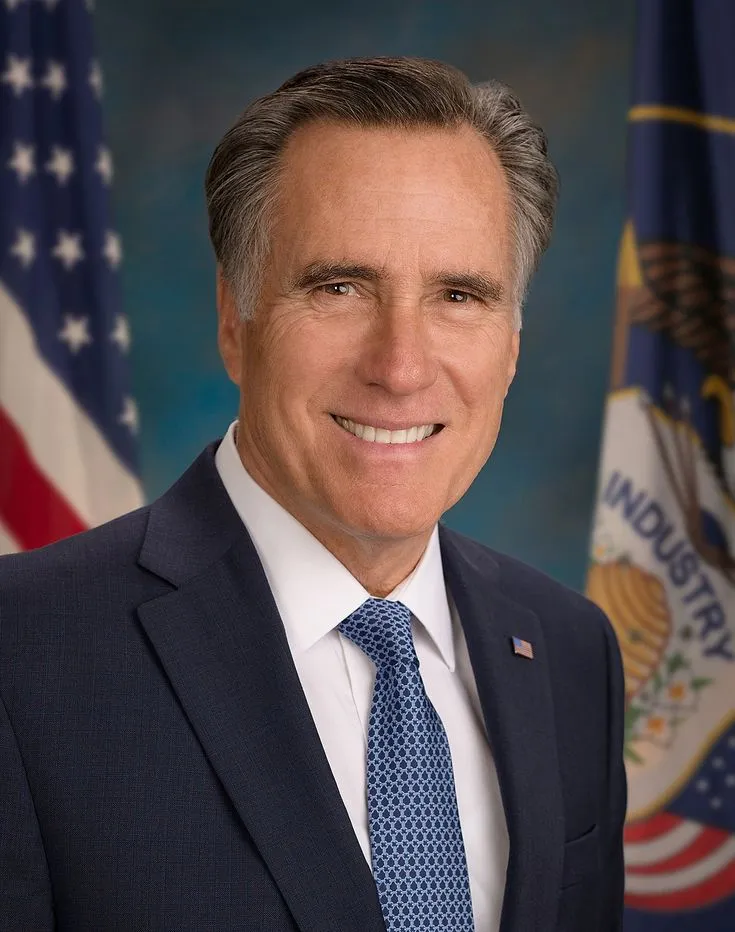

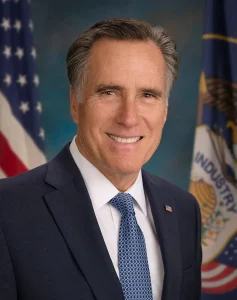

The Republican senator from Utah, Mitt Romney, delivered his farewell address to the United States Senate on Wednesday. In his speech, he advocated a return to peace and cooperation in a political atmosphere that is growing increasingly fragmented.

Romney reflected on his career, mourned lost opportunities, and pushed his colleagues to put the welfare of the country ahead of party politics in his parting speech. Romney is one of the most well-known Republicans to criticize former President Donald Trump from the Republican Party.

According to Romney, “My life’s work has been a group affair.” Romney stated that his career in public service has been a team endeavor. Starting with his time as governor of Massachusetts and continuing through his campaign for the Republican presidential nomination in 2012 and his career in the Senate, Romney has consistently positioned himself as a bridge-builder, willing to work across the aisle to effect significant change. During his departure speech, Obama cautioned against the dangers of ongoing gridlock while also recognizing the successes of both parties. This was also accurate.

Romney recounted in his speech a number of key legislative accomplishments that he had accomplished during his time in the Senate. A significant number of these accomplishments were made possible by collaboration between members of both parties. When lawmakers set aside their differences and work together to secure crucial improvements in the nation’s roads, bridges, and other infrastructure, he referenced the 2021 infrastructure law as an outstanding example of what can be accomplished.

and networks that are large in size. The improvements that were made to the Electoral Count Act in an effort to prevent future efforts to rig presidential elections were also praised by him. He also praised the legislation that were passed regarding gun safety and marriage protections that struck a balance between religious freedom and individual rights.

Romney made the following statement: “These accomplishments serve as a reminder that when we band together, improvements are attainable.” On the other hand, they also serve as a reminder of how much more we could have achieved if politics had not constantly gotten in the way of our advancement.

Notwithstanding these accomplishments, Romney expressed his profound frustration at the opportunities that were lost owing to the impasse that occurred between the parties. As a significant matter that has been frequently ignored, he referenced the nation’s ever-increasing debt as an example. When I leave this room, I will have the satisfied feeling that I have accomplished something. On the other hand, he stated, “I will also depart with the understanding that I did not accomplish everything I had sought to accomplish.”

He warned that the national debt might put the country’s economic and military power in jeopardy and detailed the catastrophic consequences that would result from it. The interest on that debt would not be a burden, and we would be able to spend three times as much on military equipment.

Specifically, he indicated that there will be three times as many cyber defenses, three times as much spacecraft, three times as many drones, and three times as many ships. There is also the possibility that we will spend twice as much as we do on our Social Security income each calendar month. Since our national credit card is almost at its maximum limit, the United States of America runs the risk of being indebted.

It was stated by the senator from Utah that if his colleagues do not take immediate action to address the debt crisis, then future generations will be confronted with significant challenges. “This is not a partisan issue,” he informed the audience. For the sake of the nation, it is absolutely necessary.

As far as Romney is concerned, the personal relationships that he established while serving in the Senate were among the most satisfying aspects of his career. Upon his arrival in the Senate, he noted, “I anticipated that I would be primarily focused on legislative and policy efforts.” As a result of my investigation, I came across a group of coworkers who, despite their differences, were all committed to serving the people of the United States.

However, Romney was transparent about the aspects of the position that he would not be willing to give up. He stated that the Senate’s “myriad meaningless votes” and its frequently burdensome procedures were a waste of time and effort, and he claimed that this was what happened. He made the following statement: “There are times when the Senate feels more like a political theater stage than a body that is engaged in deliberation.” “The people of the United States of America do not deserve that.”

Since Romney is one of the few Republican senators who has consistently criticized Donald Trump, he used his farewell speech to warn against the dangers of leadership that brings about division. According to what he said, “there are some people in this day and age who would destroy our unity, replace love with hatred, mock our moral foundation, or degrade the principles that underpin angels’ blessings.” It is imperative that we employ every ounce of our power in order to combat these forces.

Romney made the announcement that he will not be running for reelection late last year in order to clear the way for a new generation of leaders to take their place. It is anticipated that his successor, Senator-elect John Curtis (R-Utah), will take office in the month of January. During his speech, Romney expressed his unwavering faith in the ability of younger leaders to take charge and address the most pressing issues facing the nation.

There was a declaration made by Romney that read, “I leave this chamber with hope for the future.” When it comes to standing up for what is right, even when it is difficult, I hope that the leaders of the future will have the courage to do so. Rather than focusing on our differences, I hope they will keep in mind that the strength of our nation lies in our collective commitment to the ideas that have made the United States of America a global beacon of opportunity and freedom.

After delivering his speech, Romney closed it with an emotionally touching appraisal of the nature of the country and the people that live in it. He believed that the character of a nation is a reflection of both its population and the leaders that it ultimately chooses to govern it. In order to fulfill my desire to be a voice of unity and virtue, I will be leaving Washington in order to return and become one of them.

At the time of his departure from the Senate, Mitt Romney will leave behind a record that is characterized by boldness, conviction, and a willingness to break with his party when he believed it was necessary. His vote to convict Donald Trump during the former president’s first impeachment trial and his efforts to create cooperation are just two examples of the ways in which Romney has regularly been a lone voice in a political landscape that is becoming increasingly polarized.

In the process of selecting the future of the nation, his parting speech served as a reminder of the importance of moral leadership, cooperation, and unity and the importance of moral leadership. His call for a return to moral leadership and a dedication to the common good will undoubtedly resound for many years to come, despite the fact that Romney is departing the Senate.

During a time of extreme political conflict, Mitt Romney’s farewell speech provided as a powerful reminder of what they are capable of doing when leaders prioritize the well-being of the nation over partisan politics. Those who are still in Washington will be challenged by his statements to rise above the fight, to look for areas of agreement, and to lead with courage and honesty. His remarks will serve as a challenge to those who are still employed in Washington.